Russians Hold Credit Delinquencies at 16 Percent, According to Data from FICO and NBKI

MOSCOW — August 23, 2016

Top Results:

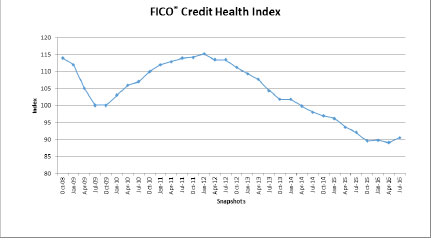

- The FICO® Credit Health Index for Russia has held steady since summer 2015, following a seven-year decline

- 16 percent of Russian credit accounts are delinquent, more than twice as many as in January 2012

- The FICO Credit Health Index measures the percentage of delinquent consumer loans and credit cards reported to NBKI, Russia's largest credit bureau

The bad rate of Russian consumer loans has held steady for a year, following a seven-year decline, according to July data from analytic software company FICO and National Bureau of Credit Histories (NBKI), Russia's leading credit bureau. The FICO® Credit Health Index stood at 90, and has remained within a point or two since July 2015.

"While the steady performance is good, the bad rate we have seen for the last year is the highest since we began the index in 2007," said Evgeni Shtemanetyan, who directs FICO's operations in Russia. "This ‘new normal' reflects the evolution of the Russian credit market, as lenders moved from secured credit to credit cards and other products that carry higher risk."

The FICO Credit Health Index measures Russia's overall credit health, based on the percentage of consumer loans and credit cards reported to NBKI that are delinquent by more than 60 days. The July 2016 index of 90 means that 16 percent of Russian credit accounts were delinquent, which is the same as July 2015 but more than twice the level of January 2012, when just 7 percent of accounts were delinquent.

Source: FICO and NBKI

Every one of the eight federal regions is below the index's benchmark score of 100, established in October 2008, but all have reached a plateau in the past year. Centralnyi, Dalnevostochnyi, Privoljskii, Severo-Zapadnyi, Uralskii and Yujnyi have all experienced a slight increase since last quarter. The average drop in index since January 2012 has been 24 points, with Sibirskii experiencing the largest drop of 33 points and Centralnyi experiencing the smallest drop of 21 points. The regions Centralnyi (index 94), Severo-Zapadnyi (index 95) and Privoljskii (index 92) are the only regions outperforming the overall index. For the current quarter July 2016, Severo-Kavkazskii and Sibirskii continue to have the lowest index value at 85.

"In our opinion, we have already passed the peak of overdue debts' growth," said Alexander Vikulin, CEO of NBKI. "Although the level of overdue loans in retail lending is still high, it's now possible to talk about stabilization of the situation with bad debts. However, the main risk remains the same — the decline in real incomes. If this trend continues, it will increase the likelihood of default for all retail credit products. Therefore, lenders need to continue to closely monitor market indicators such as the PTI (payment to income), as well as to put the ‘signal' (online monitoring of the financial behavior of borrowers) on portfolios of all types of loans, including secured ones."

FICO and NBKI share this data with Russian lenders to improve their understanding of the credit market, and help them extend credit to consumers safely and profitably. More than half of the top Russian banks use FICO® Scores delivered by NBKI.

Contacts:

Media: | Investors/Analysts: |

|

|

|

Georgia Hart for FICO | Steven Weber |

|

|

|

About NBKI

National Bureau of Credit Histories (NBKI) is the largest credit bureau in the Russian Federation. It was created in 2005, and counts among its shareholders major commercial banks and international companies CRIF and TransUnion. Its main specialty is an integrated center that stores and processes comprehensive data for creditors' decision making. As of April 2016, NBKI consolidates data about 77 million borrowers and 184 million loans from 3800 Russian creditors. The bureau provides the Russian market with modern high-tech solutions for risk assessment and control.

About FICO

FICO (NYSE: FICO) powers decisions that help people and businesses around the world prosper. Founded in 1956 and based in Silicon Valley, the company is a pioneer in the use of predictive analytics and data science to improve operational decisions. FICO holds more than 165 US and foreign patents on technologies that increase profitability, customer satisfaction and growth for businesses in financial services, telecommunications, health care, retail and many other industries. Businesses in more than 100 countries use FICO solutions for a wide range of mission-critical applications, from protecting 2.6 billion payment cards from fraud, to helping people get credit, to ensuring that millions of airplanes and rental cars are in the right place at the right time. Learn more at https://www.fico.com.

For FICO news and media resources, visit www.fico.com/news.

FICO is a registered trademark of Fair Isaac Corporation in the U.S. and other countries.